The financial world is bigger than ever these days, thanks to cryptocurrency, which has opened doors for people who had little interest in finance due to the seeming complexity of the stock market. And let’s be honest, the stock market has long seemed out of reach for most people. Very few people own stocks, but there are reports that about 60% people own stocks in recent years, 52% have retirement accounts, but only 14% directly invest in stocks. For many, the stock market is something far away and incomprehensible, but it is subject to many of the same simple things that the rest of the world experiences, and has even shut down for some strange reasons over the years.

10. Covid shut down NYSE

In early 2020, as we were all adjusting to the COVID-19 pandemic, the New York Stock Exchange also closed. It was March when it closed so that the system could switch to electronic trading and thus eliminate the need for everyone to share a floor and potentially expose themselves to the virus. The move came after two positive Covid tests.

The exchange remained closed for just over two months before reopening in May 2020 with precautions in place to allow people to return, such as wearing masks and practicing social distancing like everyone else. However, most people remained working remotely.

9. Tokyo Stock Exchange's backup system was disabled

If you’ve ever called tech support about electronics not working, the first questions they ask always sound incredibly condescending. Is it plugged in? Do you have it on? Most of us feel insulted by these questions, but the truth is that they ask them a lot because they actually are a problem. Apparently, this is also what caused the Tokyo Stock Exchange to close in 2020.

Trading was halted for the entire day, which was widely reported as a software glitch and hardware failure. Backup systems were also down, leaving traders with nothing to do all day.

So what happened to the backup system? Someone set it to "off". It had been off for five years since they updated their system, but it was never needed before, so no one noticed. Ironically, before their update, the system was set to switch back even if it was off. But the update removed that feature.

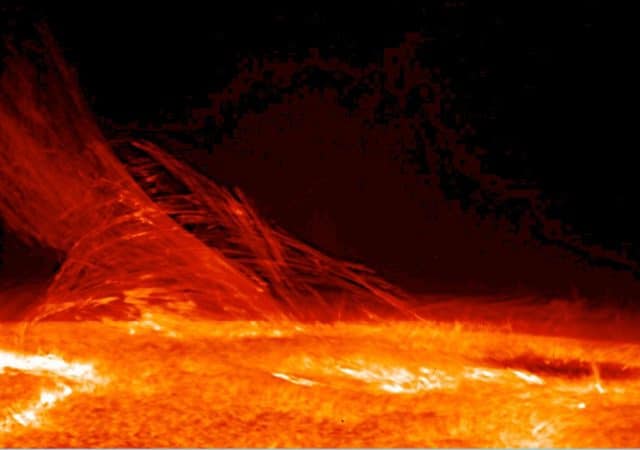

8. Solar flare shuts down Toronto Stock Exchange

Most reasons for stock market closures, as we shall see, are earthly. But not all of them. It turns out that the sun sometimes plays tricks on us, and that is what happened to the Toronto Stock Exchange in 1989, when it closed on August 16 due to a solar flare.

A few months earlier, a powerful solar flare had caused power outages in the Canadian province of Quebec and parts of Ontario. The one in August was even worse, but the one before that at least had officials prepared with some idea of what to expect and how to handle it.

Electromagnetic interference caused three different disk drives, designed to act as backups for the system, to fail one after another like falling dominos, leaving the exchange offline for three hours while repairs were made.

7. Rock band storms NYSE

American rock band Rage Against the Machine have always been steeped in politics, as if the band's name alone wasn't enough. For years, their music has been overtly political, even if a number of their fans have never realized it. One very clear example of their beliefs is that the band actually made a video on Wall Street that talked about shutting down the New York Stock Exchange.

Director Michael Moore, himself no stranger to controversial political views, was scheduled to film the video for "Sleep Now in the Fire" on the steps in front of the stock exchange. According to lead singer Tom Morello, they had permission for the steps, but not the sidewalk. And while they were filming, Moore ordered them to step onto the sidewalk. They did so, and a police officer immediately ordered them to move.

Moore told the band not to stop performing no matter what, so they kept playing. Except, being a music video, they weren't actually playing. They were just miming the moves as the song played. So the officer tried to turn off Morello's guitar, but nothing happened. Likewise, when he turned off the bass and drums. Frustrated and angry, the officer arrested Michael Moore, after which Moore yelled at the band to agree to the trade.

Morello and the team headed inside and told security they were there for the exchange. Security sounded the alarm, called the riot police, and responded by locking everything down.

6. Movie Trading Places Suspend Trading on $6 Billion

Film from 1983"Change places" , perhaps the funniest movie ever to climax on the floor of a stock exchange, sees Dan Aykroyd and Eddie Murphy team up to financially turn the tables on a pair of old millionaire con men who have ruined their lives.

The trading scenes in the film were filmed at the World Trade Center's Comex commodity exchange. This gave it a real air of authenticity, but it also created a problem. It was an actual exchange, and the crew on the road made the work impossible. The distraction of actors and filming on location during normal business resulted in $6 billion in trades being halted. Naturally, the production had to pack up and return on a weekend when the market was closed to complete the shoot.

5. Trading fell more than 40% during Simpson trial

Today, it’s hard to imagine how important the O.J. Simpson trial was if you weren’t there. You can read about it, but to understand how it seemed to dominate the media and pop culture for months is something you had to experience firsthand. In retrospect, it doesn’t even make sense, since O.J. Simpson was barely a household name at the time, a man whose professional football career had ended more than 15 years earlier and who had only starred in a handful of B-movies, as well as The Naked Gun.. franchise.

Still, the trial turned into a notorious media circus, with an estimated 150 million people watching the verdict on TV. Stock market trading then plunged 41%. A bewildering set of predictions made before the trial predicted that record numbers of people would call in sick to watch, which would devastate overall productivity, not to mention a sharp decline in housing conditions and a rise in unemployment, all linked to the trial. A stock market slump was also predicted, with traders quitting their jobs to see what would happen.

4. Groucho Marx stopped trading for 15 minutes in 1950

Groucho Marx was once one of the biggest names in Hollywood. So famous that in 1950 he was invited to the New York Stock Exchange just to check out the place and look around. Ever the entertainer, when Marx got access to the PA system, he took over and began singing “Lydia the Tattooed Lady” to the assembled traders. When they tried to take the microphone away from him, he reportedly complained that he had lost all his money in the stock market during the crash of 1929, so at least the song was his. And with that, he froze the market for a full 15 minutes.

The distraction was enough to attract the attention of traders, who stopped to watch. After all, Marx was a professional artist and had made the song famous some 11 years earlier.

3. Squirrels closed markets twice

Are squirrels plotting to financially ruin America? We'll leave that question to the zoologists. But there's growing evidence that the little rodents have set their sights on the stock market, as they've shut it down not once, but twice. Between natural disasters and war, you'd be hard-pressed to find many things that have ever shut down the stock market twice. But squirrels have.

In 1987, a squirrel shut down the markets for 82 minutes after a squirrel shorted out the electrical systems of the National Association of Securities Dealers. It was estimated that as a result, about 20 million shares could not be traded.

In 1994, another squirrel chewed through some wires that the stock market's backup systems were not prepared to replace, knocking them out for 34 minutes.

2. Loud noise shuts down European stock exchanges

What do small dogs, your grandmother, and the stock market all have in common? You want to try to protect them from loud noises that might disturb them. In 2018, it was discovered that the computers that control European markets are sensitive to loud whistles, and they can and will shut down when they have to endure those whistles.

The problem was caused by a fire alarm in a data center in Sweden. The noise from the fire suppression system was so loud that it damaged servers and knocked out stock exchanges in seven countries, including Denmark, Finland, and parts of Iceland. They had to fly in new servers, so the markets were down for several hours until something was fixed.

If you're interested in the science, it has to do with vibrations. The noise was throwing the hard drives in the servers out of alignment, essentially shaking them so hard that they were rendered useless in terms of their read/write capabilities. Noises as high as 110 decibels could impact a hard drive, and the fire alarm was producing 130 decibels.

1. Woman in a tight sweater

This entry is either the most incredible or the most completely plausible, depending on how you look at the world. In 1968, not only the New York Stock Exchange, but Wall Street itself was paralyzed by Francine Gottfried, aka Sweater Girl.

Gottfried was working on Wall Street at the time, and she walked to the office. And there's no intelligent way to say this, so we'll just leave it at what happened — groups of men milling around to look at her because she wore tight sweaters. Gottfried's figure was such that it cast what might be called an alluring silhouette, which is to say that the woman had large breasts, and in 1968, the idea of huge crowds of men leaving a woman with large breasts alone wasn't something that occurred to many people.

According to the stories, each day more and more men joined the crowd to watch her go to work, culminating in a stampede on the afternoon of September 19. A crowd of 5,000 people, some sources say 6,000, gathered, abandoned their offices and left the stock exchange unattended.

Police had to close off the street and escort her to work at the data center as the crowd damaged cars by climbing on them to get a better look. Trading stopped as bankers and traders ran to their windows to see what was happening.

By October 5, other women had also shown up to make a scene, complete with published measurements and police to control the crowd. As for Gottfried, she was said to have been offered $100,000 for a few nightclub appearances. No word on whether she would accept.

Оставить Комментарий